Financial Tips and Tricks

Published: April 2nd, 2023 by Chris McGrath

Last Updated: November 17th, 2024

Set Financial Goals

You should continually set a few micro goals for yourself that will move you forward along the spectrum of Financial Independence. Not only are micro goals a good fit for making progress along a spectrum, they're also great for helping to avoid your brain talking you out of an overly intimidating goal like Financial Freedom.

When considering what micro goals to set for yourself, it's a good idea to remember that Financial Independence isn't 100% about money. Opportunities open up when you remember Financial Knowledge and Money Management Skills are just as important. Even if you're in a bad situation where you're broke, barely making ends meet, and your ability to improve your income is limited and mostly outside of your control for the foreseeable future. What you can do is shift the focus of your micro goals to the parts of Financial Independence that you can control.

This page is intended to help you brainstorm some ideas for good micro goals related to personal finance.

Knowledge Goals

Learn and read about:

- Career options and methods for advancing within your chosen career

- Financial vocabulary words you don't know or don't fully understand

Investopedia has a solid glossary of financial terminology - How to improve your credit score

- How to save money on your bills

- Tax implications of investing and how to minimize taxes

Research Projects and Mini Quests:

- Watch the Income Inequality for All Documentary

Understand the consequences of inflation making things more expensive while wages have stayed flat for the 50 years:- Every new generation will have a harder time making it in the world than the previous.

- This is why millennials, gen z, and gen alpha are also known as the roommate generations.

- Realize that there's another benefit to investing ASAP, in addition to having more years of growth. If you view the past as easy mode, today as normal mode, and the future as hard mode. You'll realize that if you think it's hard to set aside money today, it's only going to get harder in the future, so you may as well start now.

- Obtain a good cash back credit card

- Obtain a low interest line of credit

- Open investment accounts

- Find housing / places to live that are cheap and safe

- Find used cars that are cheap and reliable

Skill Goals

Money Management and Personal Finance Skills Worth Learning:

Bookkeeping:

- You should learn how to keep a ledger, basically a financial recording keeping system, where you record and categorize your expenses.

- A personal finance ledger is much easier to implement than a corporate

ledger, it just needs to be able to help

you:

- See all of your expenses in a single consolidated view. (Usually this means you need to be able to import expenses from multiple sources: cash, checking accounts, credit cards, PayPal, eBay, Amazon, HSA, utility bills, subscriptions, etc.)

- Track your expenses over time.

- See the data in a way that's easy to analyze.

- Find a ledger methodology you like and become proficient at using it.

- You can adopt someone else's record keeping system and techniques, or come up with your own.

- Common options for personal ledgers include using pen and paper, word docs, spreadsheets, or specialized software.

Accounting:

- Use your ledger to:

- Come up with an accurate budget based on your expenses. (Real data is always more accurate than wishful thinking.)

- Make predictive forecasts based on your personal financial data.

- If you know your budget can only afford a mortgage of $x/month. It's a good idea to learn how to use mortgage calculators, insurance calculators, and algebra to find out the most you can spend on a home that fits your budget.

Miscellaneous:

- Use tax return software to do your own taxes.

- Keep track of and secure your accounts and data using:

- A password manager

- Multi-factor authentication

- Client side encryption software

- File sync and backup software

- Cloud file storage

Habit Goals

- Take the time to maintain an accurate ledger of expenses, periodically compare it against your budget, and adjust as needed. These maintenance tasks are ongoing and can only be sustained by making them a habit. My own personal habit is to spend 2 hours every payday to "square up" my personal finances by adding and reconciling entries into an informal text file based ledger.

- Develop Frugal Habits like staying within your budget.

- Generate a yearly report summarizing the state of your personal finances. Include your income, spending, debt, investments, net worth, and anything else that seems worth tracking.

- Set aside a few hours a week for self-improvement and studying. Eventually, you'll find ways of leveraging this habit to increase your income earning potential.

- Financial self-study resources worth habitually reading through:

- Periodically look for better investment options.

- Turn financial micro goal setting into a habit. It's hard to be motivated to achieve a goal when it seems impossible. Financial Independence is a goal that often seems impossible at first. Micro goals are easy to achieve, and eventually when you get enough of them under your belt. Your financial knowledge, money management skills, and progress along the spectrum of financial independence will reach a critical point where you'll have the ability to come up with a realistic plan of achieving the goal. Once you realize, A: it's possible for you to achieve and B: you have a plan for how to achieve it. Your motivation will peak, and you'll cruise into it.

Mindset Goals

Mindsets are basically just ways of thinking about yourself, the world, and things in general. A high value goal is to identify beneficial mindsets and actively try to adopt and internalize them.

Useful Mindsets to Consider Adopting:

Frugal Mindset:

- If you learn to leverage frugal habits to free up money, and combine that with investing, you'll be surprised at what's possible. Try playing around with a compound interest calculator, like the one on investor.gov.

- Imagine that because you lived frugally below your means, you were able to invest ASAP (as soon as possible) and AMAP (as much as possible). Frugal habits mixed with investing over time can make it possible to invest $500/month for 30 years. If you could do that, you could turn $180k into $1m after 30 years.

Think Longterm:

- If you can imagine $20 saved as $40-$320 saved, it becomes a lot easier to motivate

yourself to save it. Here's the trick to how to visualize $20 as more than

$20: (

1.105^7 = 2.01). Math says any money invested with 10.5% ROI will double every 7 years. Since $20 invested in a total stock market index fund can be expected to learn at least 10.5% ROI, it can be expected to double every 7 years. - When you're young and broke, that's when it's hardest to set aside $20, but it's

also when you're probably at least 28 years away from retiring. So any hard won

money you can manage to invest will have at least a 16x multiplier.

(

1.105^28 = 16.37, $20 • 16 = $320) - This is also why I label universities as Predatory Lenders: Multiply your student loan debt by 16. Your degree probably didn't help you get a job, and they convinced you to accept N years of lost work experience and lost wages during your 16x multiplier years.

- Having a longterm mindset has made it easy to motivate myself to spend the time to maintain a ledger and follow frugal habits. I regularly imagine the end state, so I never mind any inconveniences of frugal habits.

- I love my old ugly car and small frugal home, because I know those and other frugal choices and habits will allow me to stop working decades sooner than most.

Shift from a Fixed Mindset to a Growth Mindset:

- "Nothing is impossible, the word itself says I'm possible." (Audrey Hepburn)

- There's a book called "Rich Dad Poor Dad". The poor dad has a mindset of "I can't afford that". The rich dad has a mindset of "How can I afford that?"

Start with the end goal in mind, then plan in reverse:

- Planning in Reverse is a mindset I picked up from Network Engineer Academy, it's where you figure out where you want to be in 3-5 years and then think in reverse about how to get there.

- When I was a public school teacher, I asked myself how could I afford to be financial independent by age 40. I figured I could make it work if I became a Cloud Engineer while continuing to live on a teacher budget.

- No one would hire me for my dream job, so I used planning in reverse to come up with the idea of transitioning from Teacher to Network Engineer to Jr Cloud Engineer to Cloud Engineer, and that worked for me.

Be skeptical of information and learn methods of verifying it:

- Never accept any knowledge at face value.

- Learn a few rule of thumb techniques by googling things like "how to identify reliable information" and "how to tell good advice from bad." Treat the results of those rule of thumb techniques as a data point, but don't rely on them.

- Do your own research and try to fact-check knowledge you come across by cross-referencing to see if multiple sources of information reach similar conclusions. (Note, this tends to only be useful for verifying simple things that are relatively easy to prove by pointing out irrefutable evidence. Things like is the earth round and is it a good idea to invest in a specific stock market index fund. It's not a good fit for complex problems full of misinformation.)

- If someone tells you that something is a best practice, without offering step by step reasoning of how or why it's a best practice. Try to use first principles thinking to draw your own conclusions, and see if you can come to the same result / independently verify their claim.

Level up your decision-making ability by asking compare and contrast questions. Instead of whether or not questions:

- I learned that switching from Good vs Bad Decision-Making to Compare and Contrast Decision-Making leads to better outcomes from Teresa Torres' product talk blog.

- Basically, because there's never enough time and resources to implement every idea you come across, you should stop trying to think of an idea as good or bad.

- Instead, whenever you have an idea that you want to evaluate, you should build a habit of spending a few minutes to brainstorm at least one more idea and compare them to find the best idea.

- Let's brainstorm a few investment ideas:

- Invest in a bond that earns 3-6% ROI.

- Invest in real estate and do a lot of leg work to achieve 5-20% ROI.

- Invest in an index fund that passively earns 11% ROI.

- Invest in an ETF that earns 18% ROI.

- Let's brainstorm more than one career path:

- ~100k in college debt + ~$100k interest payments + lost wages + lost ability to invest + no guarantees that it'll help you earn more money. My bachelors degree took 5.5 years, and that's with taking multiple AP (college credit) classes in high school and taking extra classes / actively trying to graduate early. That bachelors degree resulted in being able to earn $37k/year in 2014 dollars as a math teacher. Some random calculator puts that at $47.3k/year in 2023 inflation adjusted dollars.

- Take a fast food job, after 5.5 years it'd be possible to work your way up to a manager position. According to salary.com, $46k is the average salary for a fast food manager in my state. Imagine instead of living with your parents for 5 years while attending college. You lived with your parents for 5 years while working a fast food job and were able to invest $100k after 5 years. Then, when you moved out, you couldn't afford to invest anymore, since you were now paying your own rent/mortgage. However, you're at least able to let that 100k sit untouched in an investment. If you let it sit untouched for 25 years at 12% ROI, you'd have $1.7 million.

- Focus on a trade school job.

- If you think about one of these ideas in isolation, as in doing the idea or doing nothing. Any idea can seem good / worth doing. Example: Investing in a bond is better than nothing; however, in reality, there's something called opportunity cost. You don't have the time and resources to implement every idea. Choosing one idea means giving up on another.

When evaluating advice, try to figure out and remember the context under which the advice was given

Human evolution caused our brains to prefer spending as little energy as possible. That's why our brains like to use cognitive shortcuts (automatic though patterns that make decision-making more efficient.)

If you can theorize the context under which advice was given, then can improve your ability to implement mental shortcut based thinking. Which improves the speed and accuracy at which you can analyze the validity of advice you encounter.

Example of a cognitive shortcut:

It's possible that while reading the above section on compare and contrast

decision-making, you may have come to the conclusion that

ETFs > Index Funds > Real Estate > Bonds

It's very possible that your brain will flag that conclusion as a mental shortcut

and, when presented with those options in the future just, answer off memorization

of the conclusion that ETFs and index funds are always best.

1st Example of implementing the mindset of identifying context:

If you implement this mindset of trying to find the context behind advice. Then the

mental shortcut of memorizing "ETFs and index funds are best." Could be augmented

to include the context. "ETFs and index funds are best for someone in a stage of FI

that's focused on growth." That way, you've left yourself a bread crumb to help

identify when it's worth reevaluating the advice.

2nd Example of implementing the mindset of identifying context:

There are well-meaning people and institutions that genuinely recommend people

go to college. Those institutions are run by imperfect humans who are likely using

a cognitive shortcut of recalling advice they memorized without considering context.

Going to college may have been a good idea decades ago, as a few important bits of

context were different back then:

- The internet didn't become full mainstream until around the year 2000. Online education platforms like Udemy, Skillshare, Coursera, and online colleges only started to exist around 2010. Even then, there were a few years of lag before they became popular and seen by employers as valuable. The majority of traditional college education has been pointless for a while now, thanks to the internet. The advice of recommending college was probably more valid in the pre-internet days. Back then, a library was the main self-study option available to compare college against.

- The cost of going to college has gone up 5x the rate of inflation over the last 50 years. So, context wise, college was more affordable back when college used to be considered good advice.

- The Income Inequality for All Documentary basically says for the past 50+ years, inflation has steadily gone up while wages have stagnated. This means it was easier to pay off college in the past, and will continue to become harder in the future.

Investment Goals

- Financial Investment Goals:

- If you have pre-existing investments like a 401k, verify that you're not invested in the defaults, if you are: look up their 10-year average ROI, then switch to an index fund with the highest 10-year average ROI available.

- If you're starting off with no goal, a great starting point is to max out a Traditional IRA each year.

- If you can consistently reach that initial goal for 2-3 years, start to play with a compound interest calculator like the one at investor.gov. Use your ledger to predict how much you can invest each year, and the calculator to predict the future value of your investments.

- Come up with your own investment goals like:

- At what age do you want to achieve Financial Independence?

- At what age do you want to achieve Financial Freedom?

- How much passive income do you need to achieve each?

- How much money do you need to generate that passive income?

- If you plan to achieve Financial Independence before age 60, you should consider using a brokerage account.

- Financial Investing is not the only kind of investing that exists:

- All of the above Financial Investment Goals have the chicken-and-egg problem of needing money in order to make money.

- Don't let not having money, become an excuse that stops you from setting investment goals. If you think you need money to invest, then you don't know the meaning of investing (generic context), because most websites only talk about investing (financial context).

- So, how do you invest without money? And how do you do so in a way that will

help you get money and achieve your financial goals?

- Investing is where you commit resources with the intended goal of developing capital.

- Time is a resource you probably forgot you have, and you can invest that resource towards developing Human Capital (knowledge and skills).

- If you focus on developing forms of Human Capital that are well known for making it easier to be employed at higher rates of pay. Then you'll eventually have enough financial capital to consider starting some financial investment goals.

Tips - Big Purchases

Home

Let's say that you have a life goal of eventually living in a big expensive house. One of the best things you can do is hold off on that until after you've achieved financial freedom. Otherwise, you'll be "house rich cash poor." By starting off with a cheap house, or co-living arrangement, you can reach financial freedom sooner. You also avoid risking losing your home to foreclosure by sticking to a house you can afford.

If you're thinking about buying a home:

- Establish a ledger (that tracks all your spending over time) and use it to come up with a budget.

- When I was first considering buying a home, I found out my budget could support a $650/month mortgage payment.

- I then used some mortgage calculators, insurance calculators, and algebra to determine that a $80k mortgage (home, realtor, and finance fees) could work out to $650/month.

- I was able to find 33 houses in my city for $0-80k.

- I cross-referenced the 33 addresses against spotcrime.com and found out 30/33 were unsafe. 3/33 houses satisfied my requirement of being cheap and safe.

- I decided to work with a realtor only after doing my own research, and in the end I ended up with a mortgage of $655/month.

Here's a rough walkthrough of how to calculate how much house you can afford:

- Let's say your budget says you can afford $800/month

- If you find a mortgage calculator https://www.zillow.com/mortgage-calculator/

You'll notice there are a few variables:- Loan Amount

- Loan Duration

- Monthly Payment

- Interest Rate

- Property Tax

- Home insurance

- HOA (Home Owners Association) Monthly Fee

- That's when you remember from High School Algebra that if you have an equation with multiple variables. If you're able to find and plug in known values for the variables until you narrow it down to 1 unknown variable, then you can solve for the unknown. Also, since you have access to a calculator, you can solve by leveraging the concept of algebra and calculator skills vs solving using math skills.

- Take some time to research plausible fixed values for a few variables.

- Googling property tax in my area says it's 1.18%

- HOA fee = 0 (If it existed, the choice would be eliminated)

- I find a house on Zillow where the price seems ballpark accurate ($115k), then plug the address of a random house I don't own into a home insurance quote calculator. Fill out the home insurance quote using googled / guesstimated values. I got a quote of $124/month for Basic coverage.

- Looked up current mortgage rates for purchasing in zip code and got a rate of 7% for 30-year fixed loan.

- Budgeting for $800/month payment

- Now that the loan amount is the only unknown variable, we can plug the guesstimated variables into the calculator and adjust the loan amount until we get a monthly payment of $800/month.

- When I plugged these values into the calculator on March 2023, I calculated that a $80k home will result in a mortgage payment of $801/month ($532 P&I, $79 Taxes, $125 Insurance, $65 PMI)

- I then searched for houses $0-80k in my and 2 nearby cities, which tend to be

more rural / cheaper. I found 3 homes available at that price with no HOA fee.

- 1 of the 3 had lots of water damage / would have been prohibitively expensive to fix up.

- 1 of the 3 was in a bad neighborhood per spotcrime.com

- 1 of the 3 was worth asking a realtor for a tour.

You can also use a mortgage calculator to figure out when you can afford a house:

Let's say you're currently in a co-living situation where you pay $550/month in rent.

Because you live within your means, you're able to put some money away into investments.

The above mortgage calculator came up with a mortgage payment of $800/month, for a $80k

home with a $0 down payment. If you know that a $80k house is possible, you can change

your single unknown variable to be the down payment. A $28k down payment on a $80k house

results in a mortgage payment of $550/month. ($346 P&I, $79 Taxes, $125 Insurance)

Car

Things to consider when looking to buy a car:

- Avoid brand-new cars:

- 2 Exceptions:

1: You've achieved financial freedom

2: You want your family to drive in the safest car possible with the newest safety features. - The average price of a new car was $49k as of Feb 2023 (source: financialsamurai.com)

- New cars tend to lose 20% of their original value in 1 year, and 40% within 5 years (source: lendingtree.com)

- $49k • 40% depreciation means losing $19.6k within 5 years, and that's the best case scenario (paying cash). It gets worse when you consider the common scenario of an auto loan with interest, plus newer cars are significantly more expensive to insure, and it gets worse still if you think about it from an opportunity cost perspective of not being able to invest ASAP/AMAP.

- 2 Exceptions:

- Frugal cars exist, and here's what I've learned from driving them for over a decade:

- My father-in-law introduced me to the fact that it's always possible to get a $2k craigslist car. They tend to be antiques (cars over 20 years old) and about 200k ±40k miles, but I've always been able to find them.

- I've always been able to trade cash for a clean title / owning free and clear.

- When I don't have cash on hand, I've been able to use my line of credit for a short term cash loan and pay it off in full within a few months.

- My personal property taxes per car have always been about $100/year.

- My car insurance costs have also always been cheap ~$1k/year.

- Originally, I'd pick whatever antique car had the lowest price, lowest miles, and newest year. (When I did that, I'd end up paying a $300-600 repair bill every 6-12 months. Temporarily having a car in the shop was never a big deal because it's easy to afford a spare antique car.)

- Later, I learned to google for cars known to last 300k miles and only buy those older cars, since doing that, I've been able to drive 200k+ mile cars and go years without repair bills. I just pay standard maintenance costs for things like yearly state inspections, scheduled oil changes, and fluid top offs.

- There is a downside to antique cars, but it's not what you might have expected. As long as you find a well maintained reliable brand and continue to maintain it, an antique car can be very reliable. The main downside to older cars is relative safety. Cars from the year 2000++ tend to be safe enough, that said, newer cars are safer and cars tend to get significantly safer every decade.

- What's a good car for most people?

- In all cases:

Only go for reliable name brands (Toyota, Lexus, and Honda) or used cars that have a history of lasting 300k miles. In addition to being dependable, they also tend to be cheaper to maintain. - If you're broke or want a spare car:

Set a budget of $2k and aim for a 20+ year old antique car. Once your finances improve, you can either sell it for close to what you bought it for and trade up to a newer, safer car or keep it as a spare. (A spare vehicle, as in one driven a few days a year / kept to avoid needing to rent / borrow / uber when your primary vehicle needs maintenance, is another scenario where an older cheaper car makes sense. If your spare is barely driven, safety is less important and avoiding depreciation in value makes sense.) - If money's tight:

Aim for a 5-20 year old car. Figure out what you can afford, and prefer newer years when possible (newer = safer). This usually offers a good balance of new enough to be significantly safer than antique cars, while still being affordable ($3-15k) and slow to depreciate in value. - If money's fine:

Aim for a 3-5 year old car. 5 years tends to be the sweet spot of being new enough to feel new, experience modern features, and benefit from modern safety improvements. While being just old enough to avoid guilt associated with opportunity cost / rapid depreciation in value associated with a brand-new car and having enough years of history for common issues and factory defects to be researchable prior to purchase.

- In all cases:

Electronics

- As a general rule of thumb, electronics are like cars in that you want to avoid buying new whenever possible. Computers and cell phones tend to lose half their value each year and keep going down over time.

- eBay is a great resource for used computers and cell phones in mint condition.

- As a general rule of thumb, I find Laptops/Desktops/Cell Phones that are 2-5 generations old or about $150-$300 tend to be the sweet spot of best bang for your buck. They will be new enough to offer great performance, yet old enough to be affordable and not quickly depreciate in value.

- It's worth pointing out that junk is also sold at that price range, but you can avoid buying junk by cross-referencing against cpubenchmark.net and videocardbenchmark.net

Tips - Recurring Costs

Internet

-

Don't rent equipment, own your own.

- ISPs (Internet Service Providers) often try to rent out all in one units that combine modem, router, firewall, and wireless access point functionality to customers for $60-300/year.

- Using your own equipment is almost always both better and cheaper.

- A $20 SB6183 Cable Modem will support internet speeds of up to 400Mbps.

- For about $60 you can buy a quality router that offers firewall, wireless access point functionality, and DD-WRT pre-installed. DD-WRT is open source firmware (a replacement operating system) that allows you to verify how much internet you're actually using.

- Another solid option is to buy a wireless mesh solution and combine it with a pfSense firewall router unit for traffic monitoring.

-

Consider using a cheaper/slower internet service

plan.

- 25Mbps down and 5Mbps up is enough to video chat and stream at 1080p, most people won't notice a significant difference in internet at these speeds vs higher speeds.

- If you doubt the rule of thumb and would rather have evidence to verify this. You can figure out how to acquire and log in to a router that supports a live traffic monitoring graph that shows how much internet you're actually using.

-

Don't trust ISP pricing, call and ask for the cheapest

option.

- When I check my ISP's pricing listed on their website, I see it offered for $60/month.

- If I google and follow different links to the same page, I'll see the same service for $50/month.

- If I call on the phone and say I can't afford that, I don't need that much speed, and I'll ask for a cheaper option. They'll either give me the same service for $40/month, or offer me an even cheaper option that's not advertised on their website.

- After I've been a customer for a year, they'll increase my price to $65/month. So once a year I make $300/hour for a single hour. I do so by spending 1 hour on the phone and have 10 minutes of internet downtime to bring my bill back down to $40/month. I do so by calling my ISP and requesting a roommate account in my name at the address where I currently have service, they give me the new customer pricing of $40/month. I then call back and cancel my original service. I've been doing this for over 10 years.

- Also, if you think those are shady business practices and wounder how they're allowed to get away with that. On the Financial Mistakes to Avoid page, I mentioned that lobbyists control the US government. Well, another fun fact is that Comcast (a popular ISP monopoly in the US) is on the top spenders list of lobbyists, they've actually spent $252m between 1998-2022 to write the laws to their advantage.

Phone

-

More people should consider using limited data cell

phone plans, as they're significantly cheaper than unlimited plans.

-

The privilege of unlimited data is far more

expensive than most people realize:

$70k after 30 years.- Americans pay about $50/month on average for a phone plan with unlimited data.

- $50/month is $600/year. If you switch to a $180/year plan, you'll be able to free up $35/month to invest in a 10% ROI stock market index fund, and 30 years of compound interest will turn that into $70k after 30 years.

- What's crazy is, if you were to choose to shun this luxury for life, and invest the $420/year that you'd save, then after 60 years of investing $35/month, you'd have $1.3m.

- All you need to do to make that happen is to switch to a cheaper plan and adopt

habits that will make it easy to get by on ~2 GB of high speed data/month:

- Pre-download maps, videos, audio, comics, books, games, and other apps when you're on free Wi-Fi so you can do things offline.

- Avoid streaming videos and music on your phone when you're not on Wi-Fi.

- Try to only use your mobile data for web browsing and live traffic data.

- The following can establish a baseline of what cheap and good looks like:

- Tracfone (a Verizon reseller) has a $125/year option. Note, I've been a Tracfone customer for over a decade. Their phone service isn't bad for what you get, but their website is terrible. Their website will show multiple options for adding prepaid text, data, minutes, and extending your service end date. It's very common for 3 of 4 click paths to lead to permanently broken webpages, and only 1 of 4 the workflow options of clicking through the web interface will work.

- RedPocket (an AT&T reseller) and Mint Mobile (a T-Mobile reseller) also have $180/year options for 5 GB of high speed data/month.

- These plans all offer BYOP (bring your own phone), where you can buy a 1-3 year old, nice modern GSM unlocked cell phone on eBay in mint condition for about $200 to use with the cheap service.

- The downsides to cheap plans are pretty liveable, here's what you can expect:

- Until eSIMs become more mainstream, you'll likely have to pay for a physical SIM card to be shipped to your home. In the case of RedPocket, they'll ship a SIM card to you if you buy 1 year of service, and they tend to offer a 7-day refund period in the event that you can't figure out how to get their service to work with your phone.

- You'll have a finite amount of mobile data. Note: A common advertisement is that you can get phone service with 500 MB of high speed data, followed by unlimited 2G data speeds. You're better off pretending the unlimited 2G doesn't exist, and just treat it as if you have no mobile data, because the majority of the internet will assume your connection timed out and just won't work at that speed.

- If you tend to use 2 GB of data a month, it might be cheaper to buy a 5 GB/month data plan, vs a 1 GB/month data plan. This is because if you run out in the middle of the month, and decide you'd rather buy extra data than wait for a refresh. Then Tracfone will charge $10 for 1 GB of carryover data, and RedPocket will charge $15 per GB of data that's only valid for that month and the unused part won't rollover to next month.

- Long wait times when calling customer support.

- You might not have a plug and play experience. For example, when I put my TracFone sim card into my GSM unlocked android phone, the mobile data didn't work until I used the internet to look up some TracFone specific APN settings to plug in to the mobile network settings.

-

The privilege of unlimited data is far more

expensive than most people realize:

-

Many Free/Cheap Home and Business VoIP Phone Plans

Exist:

- Google Voice is free for personal use and easy to set up.

- VoIP.ms offers home and business lines for $1/month. It's not easy to set up, but it has good docs where someone who understands computers should be able to figure it out without much trouble.

- These and other similar VoIP options offer calling, text messaging, incoming text messages to email inbox, incoming voicemail to email with speech to text and downloadable mp3 audio, the ability to integrate with physical corded and cordless VoIP handsets with physical answering machines, and integrate with computers and cellphones using software like Zoiper, Linphone, and Google Voice.

Supplies

- Printer Ink:

Some printers use ink cartridges that cost $40-75. If you plan to own a printer, buy a printer that uses $1-2 ink cartridges. Basically, use the price filter on a website to identify cheap ink cartridges, identify an affordable printer that uses cheap ink, check product reviews, and buy that printer.

- Batteries:

Owning rechargeable batteries will save you money in the long run.

Here are a few important things you should know before shopping for rechargeable batteries:- Batteries are potentially dangerous:

- Many batteries release toxic gases if they overheat. If they catch fire, there is a potential for those toxic gases to reach fatal concentrations.

- Poorly designed / manufactured Li-ion batteries are known to occasionally spontaneously combust and explode. (Including in the middle of the night when there's no load on them.)

- You don't need to be concerned about potentially dangerous goods bought from reputable manufactures, since they design and build multiple layers of safety features into products, use high precision manufacturing methods, and implement quality assurance processes.

- The following will help protect you from the dangers of batteries:

- Make a mental note that rechargeable batteries are potentially dangerous goods.

- If you see a battery fire, be vigilant about avoiding the fumes. Especially if you see a battery powered electric vehicle on fire. (Unpredictable winds could blow a lethal concentration of toxic gas towards you.)

-

Be extra vigilant when shopping online for

potentially dangerous goods like rechargeable batteries. Many online

marketplaces, including Google Shopping and Amazon, sell legit goods and China

sourced counterfeit goods right next to each other.

China can't be trusted to make office chairs that don't explode. So you should never trust potentially dangerous goods sourced from China. - Confused? How can a chair explode? Watch 12:26-14:00 of this video.

- Avoid buying batteries that sound too good to be true. You can do this by first identifying the price, capacity, and performance characteristics of a genuine looking options to establish a baseline. Counterfeit batteries will often advertise 2-10x capacity, which is often beyond scientific limits. They're also often a fraction of the price of the genuine product. Like $1-3/item, vs $7/genuine item.

- Avoid buying batteries from questionable sources. You could see the correct brand, sold at a plausible price, and still receive a fake product. This occurs when a counterfeit product is reskinned with the appearance of a trusted brand's name.

- Avoid leaving a battery on a charger for longer than 12 hours. It's usually ok to leave them on a charger, thanks to both the charger and the batteries having redundant safety features. That said, you should still avoid it as things like power surges, counterfeit goods, and legit goods degrading over the years can overcome safety features.

- Battery Facts - Useful for making an informed purchase decision:

- The actual voltage of a battery is based on its chemistry and depth of discharge.

- Non-Rechargeable, single-use, Alkaline AA and AAA batteries

- These are marketed as 1.5 volts batteries.

- Their chemistry follows a voltage curve of 1.5v to 0.6v

- They tend to stay between 1.5v and 1.25v until 1 amp-hour of use. (source)

- Amazon sells affordable AA and AAA Rechargeable Batteries under their "Amazon

Basics" brand name. Those are just a rebranded version of high quality Japanese

invented Eneloop Ni-MH batteries:

- They're marketed as 1.2 volt batteries.

- Their chemistry follows a voltage curve of 1.25v to 0.6v.

- They tend to stay between 1.25v and 1.2v until 0.2 amp-hours of use.

- They tend to stay between 1.25v and 1.1v until 1.4 amp-hours of use.

- Devices that take AA and AAA batteries are designed to operate within a (rarely

specified) range of acceptable operating voltages.

- Some devices are designed to work in the range of 1.7v to 1.3v, Ni-MH batteries won't work in these devices.

- If a device is able to work in the range of 1.7v to 1.2v, Ni-MH batteries will quickly die in these devices. As they'd only be within the device's voltage tolerance for a fraction of their capacity. (You could only tap into the first 15% of the batteries' capacity. The battery would still have 85% charge left, but the device couldn't utilize the remaining charge, as the remaining charge would be at the wrong voltage.)

- Here's the thing, 90% of modern day products you'd want to use batteries for: remotes, wireless keyboards, mice, gaming controls, Sennheiser Headphones, etc. are built with modern circuitry that accepts voltages ranging from 1.7v to 1.1v, so Ni-MH rechargeable batteries tend to work in 90% of devices.

- If you do have some devices that require 1.5v to operate, and you'd like to use rechargeable batteries, Kentli Li-ion AA & AAA batteries are a solid option.

- Kentli sells affordable AA and AAA 1.5v Li-ion rechargeable batteries

- Kentli batteries are made in China by a somewhat reputable Chinese Manufacturer.

China was responsible for 84.5% of counterfeit goods in 2013 per Wikipedia. China has a deserved bad reputation because of that. The flip side of it is that cheap, good quality Chinese products do exist, and Kentli batteries are an example. (I specifically use the words good quality vs high quality, as I own 40 Kentli batteries and while using them since 2018, I've noticed quality control issues related to inconsistent duration of use between batteries and self discharge issues. That said, while they're not manufactured to high standards, they're not bad.) - Because they're made in China, aliexpress.com, China's equivalent of Amazon.com is the best place to buy them from. (Reminder: there's a lot of counterfeit goods alongside legitimately cheap, quality products.) Specifically, you want to buy them from the Kentli shop on aliexpress.com, to buy then directly from the manufacturer.

- Kentli batteries are 3.7v lithium-ion batteries capped with a micro converter button top that converts the internal 3.7v lithium-ion battery that follows a voltage curve to a steady state 1.5 volt. So they basically have a solid 1.5 volt output for the entire amp-hour life of the battery.

- They do require a Kentli battery charger, as they have to be charged using lithium-ion charging specs, while avoiding the 1.5v output top button.

- Kentli batteries are made in China by a somewhat reputable Chinese Manufacturer.

- If you're interested in rechargeable AA and AAA batteries. I'd recommend owning 90-100% of Amazon Basic's rebranded Eneloop batteries, because they're cheaper, consistently reliable with no self discharge issues, significantly safer (inherent property of Ni-MH vs Li-ion battery chemistry), compatible with universal battery chargers, and they work in 90% of devices. It's pretty rare that I find something that benefits from or requires a perfect steady state of 1.5 volts.

- Batteries are potentially dangerous:

- Glasses and Contacts:

- You can use your Health Savings Account to pay for an eye exam, glasses, contacts, and even LASIK eye surgery. (If a store or website doesn't accept your HSA debit card, or you forget to use it. You can always log in to your HSA provider's website and request reimbursement.) Remember: If you put $800 into an HSA tax-free, you're probably saving around $200 in taxes. Then you can use that free money to pay for an eye exam and glasses.

- Never buy glasses in person, ever. Go to an in person store for an eye exam, but only request a vision prescription. When you're done, scan and upload it to wherever you store your important files in the cloud.

- Buy a PD Ruler (Pupil Distance Ruler), they're like $6 on Amazon. The reason for this is since I upload all my vision prescriptions online, I was able to realize a shake my head moment: My last 3 vision prescriptions have 3 different PD measurements, that measurement shouldn't change for an adult. That tells me that eye doctors can't be trusted to diligently measure pupillary distance. Given how cheap a PD ruler costs, you may as well buy one, figure it how to use it from a quick internet search, and measure it yourself to be sure.

- You can use your eye prescription and validated PD distance to buy prescription glasses online for a fraction of what they cost at an in person store. A quick internet search will reveal many options to choose from, and thanks to the internet making it easy to find and compare prices between competitors, prices stay low.

- FramesDirect.com is an international online eyewear retailer that's been around since 1996. ZenniOptical.com, founded in 2003, lets you upload a photo of yourself and virtually try on glasses. The point is, the practice of buying glasses online has been around long enough that you can expect a great user experience.

Subscriptions

- Vision Insurance

- As a rule of thumb, you don't need this, there's only 2 cases where it makes

sense to have it:

- If you're getting it for free. (Which is a common employee benefit.)

- If you're considering LASIK eye surgery.

- Vision Insurance is basically useless if all you need is glasses or contacts.

- If you pay for vision insurance, you can expect:

- To pay about $60/year, or $180 after 3 years.

- You can't use tax-free HSA dollars to pay for that cost.

- Normally you get a free yearly eye exam and a discount from in-person glasses stores.

- If skip vision insurance, you can expect:

- To benefit from an eye exam about once every 3 years, and to pay a 2024 average cost of $60 for the eye exam without vision insurance.

- You can use tax-free HSA dollars to pay for that cost.

- So we're basically comparing $180 every 3 years vs free. We're off to a great start, but it gets worse. It's common for prescription glasses purchased online without insurance to be cheaper than glasses purchased in stores using a vision insurance discount.

- If you pay for vision insurance, you can expect:

- As a rule of thumb, you don't need this, there's only 2 cases where it makes

sense to have it:

- Car and Mortgage Insurance

- It's worth comparing rates if you never have. It's also worth a follow-up if you last checked 3-5 years ago, since rates change over time.

- Road Side Assistance

- Car insurance providers often offer this subscription as an add-on to their insurance offering.

- In my experience, third party road side assistance subscriptions tend to be cheaper,

respond faster, and offer a greater distance on their free tier of towing. This

allows you the choice of being dropped off at a good mechanic vs the closest

mechanic at no additional charge.

Here are 2 third party road side assistance services worth considering:- Auto Road Service (I've used over a decade)

- AAA (Good reputation, but not offered in my area)

- Streaming Services

- Periodically audit how many streaming services you're paying for. Instead of paying for 5-10 at once, you might be able to pay for 2-3 at a time and periodically swap them out as you watch all the content you're interested in.

- Unnecessary Subscriptions

- It's possible to buy Amazon Prime Video separately from Amazon Prime.

- You can get free shipping without Amazon Prime. I'll often add items to my cart and just wait until I've added $35 of eligible items. Then they become eligible for free shipping.

- Lots of unnecessary subscriptions exist:

- Subscription supported blog sites like Medium. They tend to offer 3 free articles a month. You can easily bypass that limitation by using a different browser or incognito mode.

- YouTube Premium:

Brave is a Chromium based web browser that blocks YouTube ads by default.

Browser extensions like uBlock Origin can block ads for free. - If you pay a subscription instead of using an ad blocker, because you want

to support online content creators. Know that there are other options that

are usually better for both you and them.

- The majority of subscription platforms are for profit businesses. It's very common for profits on ad revenue sites to go 100% to the business. In rare cases where systems are put in place to allow content creators to get a piece of the ad or subscription revenue. They'll usually be given a fraction of the value they generated. (A 50% cut, before taxes, isn't uncommon.)

- Alternatively, you could just use an ad blocker and "tip" any content

creators you think could use support. It's likely cheaper for you than

buying a subscription, and the content creator will get more of the

money you send.

Notes of Interest:- The word donate is often incorrectly used in the context of supporting content creators. This is because many people think of donate as meaning to give money, but from a legal / tax perspective, donate is intended to apply solely to non-profit organizations.

- "Tip" is the correct verbiage to use, as any money given to a content creator is treated as taxable income. It doesn't matter if it's worded as donation, gift, tip, or patronage. It doesn't matter if you intended it to be a gift and the recipient saw it as a gift. (Gifts between IRL-friends and family are non-taxable.) What matters is the perception of an independent third party IRS Auditor. If it even remotely looks or smells like quid pro quo (this for that), then they can classify the transaction as a tip subject to income tax.

Tips - Cashflow

Slowly Pay Low Interest Debts

If you have the ability to pay off a low interest loan early. You might be better off carrying the balance as long as possible, as doing so frees up money that can be used to invest as much as possible.- If you have a mortgage or student loans, it's likely that you have a low interest rate loan, by low, I mean one that is near or below the rate of inflation.

- If you ever end up with spare money from a budget surplus, tax refund, end-of-year

bonus, or inheritance, you're usually better off investing it rather than paying

off a low interest loan early. Imagine you have a large loan with a 5% interest

rate, and you find yourself with an extra $1k.

- At first glance, it looks like you could save $50 in interest, by pre-paying $1k on your low interest loan; however, there are alternatives worth considering.

- If you're in the survival stages of FI, living off passive income, or have unstable passive income, you could potentially find a bond/CD that gives 6% interest. So investing $1k would result in you earning $60 in interest. Then you use $50 to pay off your low interest debt, and you come out ahead. As a bonus, bonds can double as a rainy day fund.

- If your finances are solid, and you're in the growth stages of FI. Instead of bonds, you could consider paying minimum monthly payments and investing the rest in the stock market at an average growth of 10% ROI.

- Another big reason to slowly pay off student loan and mortgages debt is they both tend to have tax write-offs associated with them. So the slower you pay them off, the longer you can benefit from their tax incentives.

Interest-Free Small Loan Trick

There's a trick you can use with a credit card to

effectively get an interest-free small loan.

You can carry a small balance on it year round without paying any interest on that

balance.

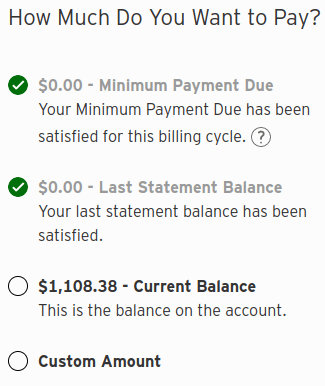

You may have heard that although credit cards are known to have high interest rates (~18%) you don't have to pay interest on your credit card as long as you pay off your balance in full each month. When you go to pay your bill through the online web portal, you'll see some interesting wording in the interface.

The trick here is that you don't need to keep your Current Balance at $0 to avoid paying interest. You won't pay any interest as long as your Last Statement Balance is zero. So as long as you have a stable job/income you could leave your Current Balance at ~$1k, let it transition from "Current Balance" to "Last Statement Balance" over a billing cycle. Spend another ~$1k, such that your Last Statement Balance is $1k and Current balance is $2k, and then just pay the last statement balance of $1k. By using this trick, you can carry an interest-free loan balance of $1k for as long as you're willing to closely monitor and maintain the juggling act.

Note, one of the reasons I'm calling it a juggling act is that in order to use this technique, you can't use automatic payments. It only works with manual payments, so if you want to use it. It's necessary to adopt good habits, figure out a reminder system that works for you, and practice it until you're confident you can smoothly pull it off. (The "Rainy Day Fund" sections below cover scenarios explaining how to practice the technique.)

Rainy Day Funds don't belong in Bank Accounts

Savings accounts are scams that banks try to sucker people into. The bank will profit from investing your money. You'll be left will less spending power than what you started with, since the interest they'll give you will be lower than the rate of inflation. Any spare money you have should always be invested.

"What? But I was always told growing up that it's important to have a rainy day

fund for emergencies"

Having a rainy day fund is a good thing, but it's bad to keep it in a checking

or savings account. There's nothing stopping

you from allowing your rainy day fund to double as an investment fund.

If you're using a savings account as a rainy day fund, you should consider replacing it with a credit card, line of credit, and investment funds in a brokerage account.

- Ideally, you should make sure all your credit cards, lines of credit, or other high interest debts are fully paid off before you start a rainy day fund.

- If you don't already have a credit card, line of credit, and brokerage account. Sign up for each of them.

- Credit Card:

- By mastering the interest-free small loan technique, your credit card can act as a 1st layer of defense against light rain. (If you just have a small deficit of a few hundred dollars, you won't even need to touch your rainy day fund. Not touching it is useful when it's growing in an investment fund.)

- Aim for the ideal of a 2% cashback credit card with no yearly fee, like the Citi Double Cash Mastercard.

- Alternatively, if you have no credit history or bad credit, you can get a security deposit credit card as a starting point, which will help you build your credit score.

- A small credit limit of $300 is fine to start with, but slowly increasing the credit limit can give you more flexibility and a large credit limit will ensure you stick to a low percent of used credit, which is a significant factor in your credit score.

- Brokerage Account:

- A brokerage account can be used as a rainy day fund instead of a savings account.

- Savings accounts tend to offer 1-2% interest, resulting in loss of money to inflation. Their only advantage is they have 100% liquidity (ability to immediately convert to cash.)

- Bonds can grow at ~4-6% (slightly higher than inflation)

- Stock market index funds can grow around 10%.

- The only disadvantage of investment funds is that they lack 100% liquidity, it's more like 90%. You can still get cash quickly, but there might be a 3-5 day lag.

- Fidelity and Vanguard are both are great options for opening a brokerage account that you can use to buy and sell bonds and stock market index funds. I like Fidelity a little more as it offers more options.

- A brokerage account can be used as a rainy day fund instead of a savings account.

- Line of Credit:

- A LOC offers 3 amazing benefits:

- Overdraft Protection:

If you don't have a LOC and you overdraft your checking account (withdraw money you don't have), you can get charged with a $20-35 fee even if you just tried to withdraw a dollar. I'm able to safely maintain a $0 balance at all times, because when my account overdrafts, it just automatically borrows money from my LOC, which means I never pay overdraft fees. - You can use it to overcome the primary weakness of credit cards: insane interest

rates

You're only charged credit card interest rates if you carry a balance on your credit card. You can transfer your credit card balance to your LOC, which allows you to permanently replace credit card interest rates with LOC interest rates. In other words, a LOC allows you to compensate for the weaknesses of a credit card while still being able to benefit from their strengths. - You can use it to compensate for the weakness of a Brokerage Account: Liquidity Gap

Let's say you have $6k invested in your brokerage account. You need $5k cash, and you need it today (during banking hours). There's going to be a 3-5 day lag on converting your brokerage account to cash. So you compensate by using your LOC as a buffer. You go inside the bank and withdraw $5k cash from your LOC. Then you start the process of sending $5005 from your brokerage account to your checking account to pay off your LOC. So, although you borrowed $5k at 10% interest, you were able to pay it off within 3 days. That means you pay $4.10 in interest($5000•0.10/365•3). That's only in the scenario where you need it immediately. If you can wait 3-5 days, you don't need to pay any interest. And that $4.10 is nothing when you consider the fact that your rainy day fund has been growing in an investment fund.

- Overdraft Protection:

- Aim for the ideal of a HELOC (~4-7% interest) opened through a Credit Union with a 10-year draw period.

- The next best thing is an unsecured LOC (~9-12% interest) through a Credit Union.

- It's advantageous to aim to increase the credit limit of your LOC, for the same reason it's useful with credit cards.

- A LOC offers 3 amazing benefits:

RDF - Survival Optimized

Any time you have spare funds - You buy bonds in a brokerage account. Those bonds become your rainy day fund. When you add a credit card and LOC on top of your bond fund, you're able to maximize the overall efficiency of your rainy day fund and compensate for some traditional weaknesses of credit cards and brokerage accounts.Why Bonds Instead of Index Funds?

- Short Answer: Bonds can be a better fit for the survival mode stage of FI.

- The thing is, bonds are significantly less volatile than stocks. With proper laddering, you can make it, so they can't lose money, and have them generate a fixed ROI of ~4-6%. Stocks on the other hand, are volatile, their ~10% ROI is just an average over the long run, in reality they can temporarily lose 40% of their original value and take 1-5 years to recover from the temporary loss.

- If you're in the survival stage of FI, you'd probably prefer a consistently predictable rainy day fund that you can rely on. Vs risk a double whammy of investing 10k in a rainy day index fund, then having it go down to $6k in your time of need. Then realizing that withdrawing 1k is more like withdrawing 1.6k but only receiving 1k when you factor in the potential for the market to rapidly bounce back.

- Remember, FI and the stages of FI exist on a spectrum. If you're in the survival stage, you might want to be 100% invested in bonds until you hit $5k. Then, as you move closer to the next stage of FI, you might decide to put some amount of funds beyond $5k into index funds. That'd help you grow to the next stage and give you the option of selling off index funds during good years or bonds during bad years, if you ever need to tap into your rainy day fund. Think for yourself, be your own fiduciary, and do what makes sense for you.

Implementation Details of a Survival Optimized Rainy Day Fund:

- Practice the trick of using a credit card to carry an interest-free small loan, try to carry a small interest-free loan of $100 for 12 months. This way, you'll understand the technique and be confident that you can pull it off in practice. The significance of $100 is that it's high enough to validate that you're implementing the technique correctly. Yet low enough that you won't be screwed if you make a mistake. Practice is important because you can't depend on auto payments. Leveraging this trick requires manual payments. Which means you need to develop a combination of solid habits and a reliable reminder system.

- You should aim to maintain either a $0 balance on your credit card or continue

to maintain the interest-free loan of $100 if you want to make sure you stay

sharp.

This scenario should give you an idea of how it works:- Normally every 2 weeks:

- You spend $400 on your credit card.

- You earn a $500 pay check.

- You pay your balance off in full.

- Rain hits you with an unexpected $300 car repair bill:

- This time you spent $700 on your credit card.

- You earned $500.

- Even though you can't fully pay your credit card off, you're able to use your new-found powers of financial wizardry to temporarily float a $200 interest-free loan for 30 days. You're able to pay it off in full 2 paychecks later.

- Normally every 2 weeks:

- Here are 2 examples of how you'd use your LOC to avoid insane credit card

interest rates:

- 1st scenario of using LOC to avoid credit card interest:

Your car breaks down, and you need to buy a craigslist car for $2-3k. Cash only.- Technically, it's possible to withdraw cash from an ATM using a credit card, but there's usually limits and fees. Instead of your normal interest rate of ~20% that's floatable, you get charged 30% interest starting immediately. So you should basically never take a cash advance using a credit card.

- Instead, you can borrow cash based on a LOC's lower interest rate.

- 2nd scenario of using LOC to avoid credit card interest:

Some appliance needs to be replaced or repaired, and it's going to cost $1k- You put $1400 on your credit card. ($400 normal + $1k unexpected expense)

- Since you only earn $500 per paycheck, you don't have enough money to pay off your credit card, but you pay what you can.

- You're able to float the $900 loan interest-free for ~30 days. Because you used the trick of paying your last statement balance of the previous month in full vs the full balance, but that was enough to not be charged interest on this new month's purchases. At this point, you've only bought yourself time.

- After a few days, your balance grows to $1300 ($900 carried over temporarily

free of interest + $400 in new expenses), you have 5 days until your bill is

due. This time, your last statement balance is $900, so you'll need to pay

$900 out of $1300 of the balance in order to not be charged interest. You

don't have $900 cash to pay your credit card's last statement balance, but

you do have income from your job which allows you to pay $500. But you'd

still be short by $400.

This can be a little tricky to follow, so let's break it down:- $1300 <-- Current balance on credit card

- $900 <-- Last statement balance (paying this much allows you to temporarily avoid paying interest)

- $500 <-- Expected income from paycheck that you'll be able to put toward last statement balance

- $400 <-- The amount you're short by, if you could come up with it, you could avoid paying interest on your credit card.

- Here's where your line of credit shines: Instead of carrying a $400 balance on the credit card which will charge you some insane interest rate like 20%. You borrow $400 from your LOC as cash, and use it to pay the last statement balance of your credit card. This makes it so you never have to pay the crazy interest rate advertised on your credit card, it's also why I prefer cash back credit cards, their only downside is their high interest rate, which can be avoided.

- You'll still end up borrowing $400, only instead borrowing against your credit card at a 20% interest rate. You'll borrow using the LOC's ~10% interest rate, then try to pay it off ASAP (as soon as possible).

- Point of Clarification:

I mentioned borrowing money from the LOC in the above example to help clarify the value of a LOC. In reality, that's just 1 of 3 ways this scenario could play out, here's the full 3:- You don't have sufficient rainy day funds in your brokerage account.

You just literally don't have the money to pay off your credit card. Well,

at least you're borrowing at 10% interest. It sucks, but paying it back

would be doable. Also, you wouldn't plan to have that debt long term,

you'd try to pay it off ASAP. If you managed to pay it back within 70 days,

you'd actually only pay ~2% interest. (

10% interest is based on 365 days, 70/365•10% = 1.9%) - You have enough money in your brokerage account to pay the $400 you're short

by. Your credit card is due tomorrow/you must pay today to avoid getting

smacked by your credit card's high interest rate. Problem is, it'd take 3-5

days to sell an investment and then transfer money from your brokerage

account to your checking account. You can use your LOC to get immediate

access to cash, immediately pay your credit card to keep it interest-free.

You'll borrow $400 from your LOC, then pay it off in full 3-5 days later.

You'd end up paying $0.33 (

3/365•10%•$400) for immediate access to your funds, not bad at all. - You have enough money in your brokerage account to pay the $400 you're short by. Your credit card bill is due 10 days from now. You can safely wait 3-5 days to transfer $400 from your brokerage account to your checking account. So it's possible to pay off your credit card using your rainy day funds without having to take a short term loan. So staying on top of due dates and solid money management skills save you $0.33 or whatever the interest is for a short term loan. But if you're in a pinch, it's nice to know the 2nd option of taking a short term loan exists.

- You don't have sufficient rainy day funds in your brokerage account.

You just literally don't have the money to pay off your credit card. Well,

at least you're borrowing at 10% interest. It sucks, but paying it back

would be doable. Also, you wouldn't plan to have that debt long term,

you'd try to pay it off ASAP. If you managed to pay it back within 70 days,

you'd actually only pay ~2% interest. (

- 1st scenario of using LOC to avoid credit card interest:

- When it comes to your actual rainy day fund - The spare money you put into your

brokerage account to invest in bonds. The following should give you an idea of what

the process of transferring money from your brokerage account to your checking

account might look like:

- You need to withdraw 1k from your brokerage account.

- After ~2 years of saving, you managed to purchase $6k worth of bonds that pay 5% interest. You spread the 6k purchase into 12 transactions of $500 to form a bond ladder to follow the best practice of evenly spreading out the maturity dates and interest (which is paid twice a year for a single bond.)

- Your Bonds were able to earn $500 in interest after 2 years.

- Due to bond laddering, it's probable that you could have a 1-year bond reaching its maturity date (the date you get your principle back). So one of your bonds will have probably matured to $500 cash. So there's a possibility that you could just happen to have $1k cash in your brokerage account.

- It's more likely that you'll have a mix of cash and bonds in your BA, and need to sell some bonds to raise cash. If you have to sell a bond before it's matured, you'll lose some of your original principal. Example: You buy $500 worth of bonds that are supposed to mature after 1 year. Let's say you cash in your bond after having owned it for 7 months / when it's not fully mature. Instead of getting back your original $500, you might get $490 back. But at the same time, you could have been paid $12.50 in interest when the 6th month hit. So from selling it off 5 months early, you could have only ended up making $2.50 (0.5% interest instead of 5% interset).

- Note: Due to the fee associated with cashing in a bond before it has matured, it's possible to lose money on a bond. This would happen if you were forced to sell a bond before you owned it for at least 6 months. (As you'd get hit with the penalty fee without having ever benefited from the interest that could help offset the penalty fee.)

- Since it's possible for bonds to lose money if you have to sell them before

their maturity date. It's a reasonable idea to keep a small amount of cash in

your checking account, and own a mix of index funds and bonds. This will give

you more options when it comes to freeing up funds to cover a deficit caused

by a rainy day event.

- Index funds are great for this purpose. If you own some of these, and you have no short term bonds that are close to maturity and the stock market is up. You can raise the necessary funds by selling some of the index funds at a profit, instead of selling a bond at a loss.

- Keeping a small amount of uninvested cash isn't a bad idea either. You can use this if you have no bonds that are close to maturity, and you need money at a time when the stock market is down. (You don't want to sell your index fund at a loss, and if you just hold onto it for longer, its value will recover and then grow again.)

- Fun fact: HSA's force you to follow the practice of keeping a small amount of uninvested cash for this very reason. Basically, they won't let you invest any more money until after you've a $1k cash balance.

- Note: If you invest in bonds and stock market index funds in a brokerage account, you'll generate some additionally yearly income. Which will cause you to get taxed now instead of taxed later, which is usually preferable. This is unlikely to be an issue in this scenario, because if you're in the survival stage of FI, you're likely in a lower tax bracket, in which case paying taxes now vs later could actually be a good thing. You can always rebalance the allocation of your investments in the future when you feel you've moved up to another stage.

RDF - Growth Optimized

I consider myself to be in the Growth Stage of FI. I currently own 0 real estate Assets, 0 dividend focused Index Funds, and 0 bonds in favor of being 100% invested in growth focused index funds and ETFs. This is because I believe it's the most optimal asset allocation for the growth stage of FI. I'm explicitly pointing out this clarification, because I don't want readers to mistakenly develop a mental shortcut belief that this is the end all be all best asset allocation. The context of what stage of FI you're on should be taken into context when trying to optimize asset allocation. When I move to the next stage of FI, I plan to rebalance my assets to be optimized for that stage.

What makes this section mildly interesting is that, in the name of financial optimization, I purposefully aim to maintain a $0 balance in my checking and savings accounts at all times. Every paycheck, cash back deposit from my credit card, tax return, etc. I pay any bills I have coming due, then immediately invest any extra money, which leaves a $0 balance. The interesting part is that I leverage money management skills to have a pseudo rainy day fund without having any money set aside for rainy day purposes. Which brings up the question of how does that work?

Implementation Details of a Growth Optimized Rainy Day Fund:

- Prep work that allows this setup to work:

- I have income higher than my budgeted expenses and a sense of job security.

- I have a credit card limit of 10k.

- I have a LOC with a 30k credit limit (6-months of expenses)

- I have a brokerage account (BA) with investments. Mostly growth focused index funds, which allow taxes to be differed, which creates an effect similar to that of a Roth IRA, but without the early withdrawal limitation.

- Note: You could also use a Roth IRA's original contribution in place of a BA, but then you'd create a chore for yourself in the form of needing to closely keep track of your original contributions minus withdraws. Also, a BA + Traditional IRA is more tax efficient for most people.

- I have no intention of ever withdrawing money out of my BA, but it gives me peace of mind to know that I have the option of liquidating a small part of it if I was ever in a pinch; like being unemployed for longer than 6 months. As long as I'd be able to find a new job within 6 months, I wouldn't need to touch it.

- I try to keep my credit card balance near zero and primarily use the interest free small loan credit card trick as my primary buffer against unexpected expenses. My yearly budget for expenses is currently $63k. I try to use my credit card for as much as possible since it allows me to get 2% cash back and use the small loan trick. I usually end up spending $40k/year on a credit card, which generates $800/year in free money from cash back. Also, $40k/12 means I tend to spend $3333/month on my credit card. That means my last statement balance is always about $3k, so I can always float an interest-free small loan of up to $3k. Since I have a steady job with some surplus income, that $3k buffer is enough to handle the majority of unexpected expenses.

- When an unexpected expense comes up, like my car dies, and I need access to $5k cash to buy a used car off craigslist. I can transfer $5k from a line of credit into my checking account, and have immediate same day access to $5k cash.

- If my LOC has a balance, I'll temporarily pause investing as much as possible until I've paid it off in full.

- I choose to not bother liquidating any investments to pay off the LOC, because the LOC's interest rate is 10%, which is about even with long term investment returns. So I just temporarily carry a small loan balance and pay the interest on it until I can pay it off using surplus income from my job. I like how this simplifies life, as I don't have to be concerned about the short term volatility of the stock market or deal with the hassle of liquidating investments.

- Another option available that I usually avoid for reasons of simplicity and

preference.

Let's say I borrowed $5k against my LOC and I wanted to pay it off. If the

stock market was doing well, I could choose to liquidate some invested assets

at a gain. I'd have the option of withdrawing $5005 from an investment account.

It'd take 3 days for those funds to enter my checking account. I could then use

them to fully pay off a $5k line of credit loan within 3 days. Which would

work out to $4.11 in interest from borrowing $5k for 3 days.

(

$4.11 = $5k•10%•3/365) - So what if I had a financial emergency where I lost my job and might be out of

work for a few months?

- I'd look into opening up a HELOC that would allow me to gain access to a credit limit of up to 85% of my home's equity at 4-7% interest.

- Alternatively, I'd use my LOC's credit limit of $30k (6 months worth of expenses) as my rain day emergency fund. (Even if I ended up carrying a balance of $30k on it and had to pay 10% interest. I'd have $30k invested in stocks that would also be averaging 10% interest. Which would balance out the cost / allow me to not sweat carrying a balance that temporarily grows for a few months.)

- If the stock market was in a good year and I was up by more than 10%, I'd liquidate some investments to pay off the LOC to maintain my runway.

- If the stock market had just crashed by 40%, that wouldn't be a big issue either. Even though my brokerage account aims to be growth focused, there are still some dividends generated. I could use those to pay the minimum interest payments on the LOC. Or sell off just enough to afford the minimum monthly interest payments, and purposefully let the balance grow from $0 up to the limit of $30k. The reason I'd do this is because the stock market will likely bounce back from a crash if I wait a few months. I can then minimize the amount of investments I'd sell at a loss.